What do we mean by "the market"

Typically this refers to a wide range of stocks that can be traded. Often this is filtered by market cap, so maybe we consider the largest 500 companies in the US for example (like the S&P 500). Sometimes it is filtered by sector, or by exchange (like the NASDAQ).

Ultimately though we are talking about a basket of stocks and not just individual companies when we talk about "the market".

It is easy and effortless to invest in these via ETFs, and so if you are going to go to all the effort of analysing different companies, and trying to pick the best stocks, you would want to know that your investment returns are higher than if you had simply "bought the market" (i.e. bought passive ETFs).

What drives market returns

The majority of companies are quite stable in their returns. They are mature companies that have saturated their markets. Take for example this well-established British company, Marks and Spencer.

The provide mainly clothing and food. As you can see, over the last nearly 40 years, the stock has ranged between 200 and around 700 at its peak. But there could be times that your average return over that period is nearly zero. If you'd bought at 400 in the mid 1990s, then you'd basically still be even if you were holding today.

Sure you will also get dividend payments from these types of companies, but in terms of equity growth it is not that impressive.

The Big Hitters

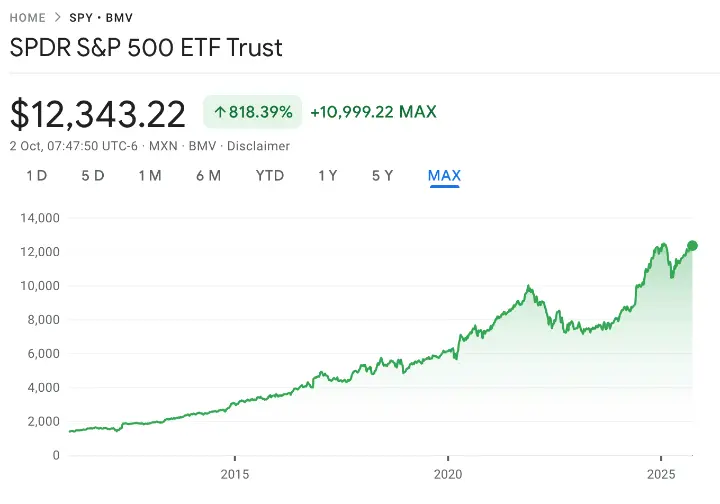

So if a large percentage of the companies are treading water, how do we explain the growth in the S&P 500.

Do you see this nice steady growth year-on-year? Sure there are good years and bad years, but overall you can see much healthier growth in "the market". So while most companies are relatively stable, and yes some do go bankrupt, the market returns are driven by the few companies that can literally 100X in value over that period.

So if you imagine a basket of stocks, where most of them are growing at a few percentage points per year, a few crash out to zero, then it's peppered with companies that are growing 100X over that period, you will see why the overall market is growing at a healthy 8%-12% per year.

How to pick the winners?

The million dollar question (literally). The problem is - to do this you have to concentrate your portfolio into the winners, instead of diversifying out into the market. Otherwise your gains on the big hitters get watered down by the losses or average returns of the other stocks.

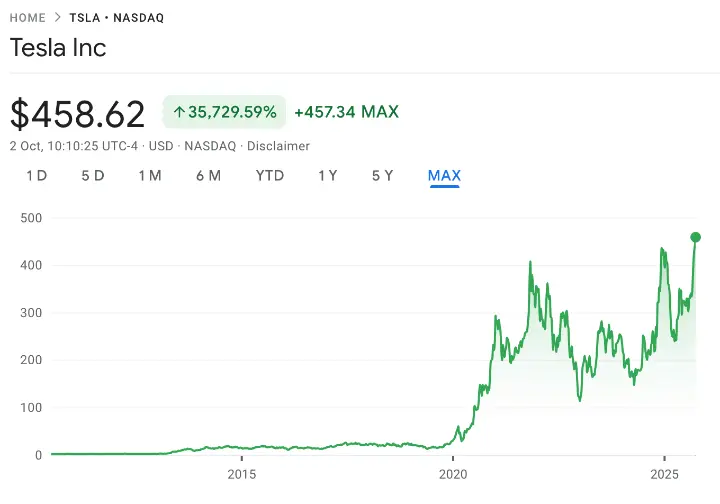

So of course, if you had bought Tesla in 2015, and nothing else, you would have absolutely crushed the market. Clever you.

But let's see how clever, what if you'd bought into plug power early in their history?

Hmm, not so clever now are we. So let's not pretend it is so easy to know in advance which companies are going to be a roaring success, and which ones are going to be a major flop.

By concentrating you will drive your returns away from the average into more extreme territory. The only problem for you is, you don't know which way from the average this is going to go!

If you can do this consistently year on year, then you have what's called "an edge". This is what makes investors like Warren Buffet or Michael Burry so special. They didn't just do this once, they kept beating the market year after year. They have a deeper insight into the mechanics of the market and are able to consistently concentrate their portfolio into the winning areas (at least more often than the losing ones).

If you don't have an edge, you are not investing. You are doing something called gambling. For example, buying random NFTs in the hope one will go to the moon, or getting involved in tiny market-cap crypto-currencies in the hope that it will 1000X.

You can do all of that, or you can go to the casino, it's up to you. But the house always wins. So while you will get the odd story of a guy making it big on Dogecoin, that massive win is funded by millions of losses of other ordinary people. It is not much different to the lottery and will likely have the same outcome - you getting nothing.

Alternative assets

Another way to try and get an edge is to get outside of the stock market and into alternative asset classes. Different asset classes can have different risks and different returns, but also it can be easier to develop an edge. The stock market is absolutely massive, and there are hundreds of thousands of people who spend all day every day trading at large institutions. For the average investor, your hopes of out-performing these guys are relatively small.

What I've been doing over the last few years is investing in show-jumping horses. By working with people who have specialised knowledge of this industry, we have an edge over the market and are able to generate returns in excess of what the stock market produce.

I still invest in stocks and property and other more traditional assets, but by leveraging the unique skills and connections of people within this industry a genuine edge can be created.

I'm not just buying random horses and hoping one will become a winner (like people do in race-horsing), there are specific reasons as to why we are able to generate out-sized returns. Feel free to contact me for more information on how I'm doing that.